Family offices in startups funding

Published

Jun 25, 2025

Topic

Post Written by Vasily Alekseenko

Subscribe to Rare Founders' for a weekly newsletter of handpicked startup events for founders and investors in London 📩 = https://rarefounders-newsletter.beehiiv.com

There’s a quiet shakeup happening in startup funding — and if you’re only looking at VCs, you might miss it.

Family offices — private investment vehicles managing the wealth of ultra-high-net-worth individuals — are increasingly bypassing VC funds and investing directly in startups. In 2023, they accounted for nearly one-third of global startup capital (PwC). VC fundraising, meanwhile, dropped over 60% in 2024 (Financial Times).

And in 2025? According to BNY, 64% of single family offices say they plan to make six or more direct investments this year. That’s no small shift — it’s a sign of how the centre of gravity in early-stage funding is starting to shift away from traditional venture.

What’s Changing — and Why It Matters

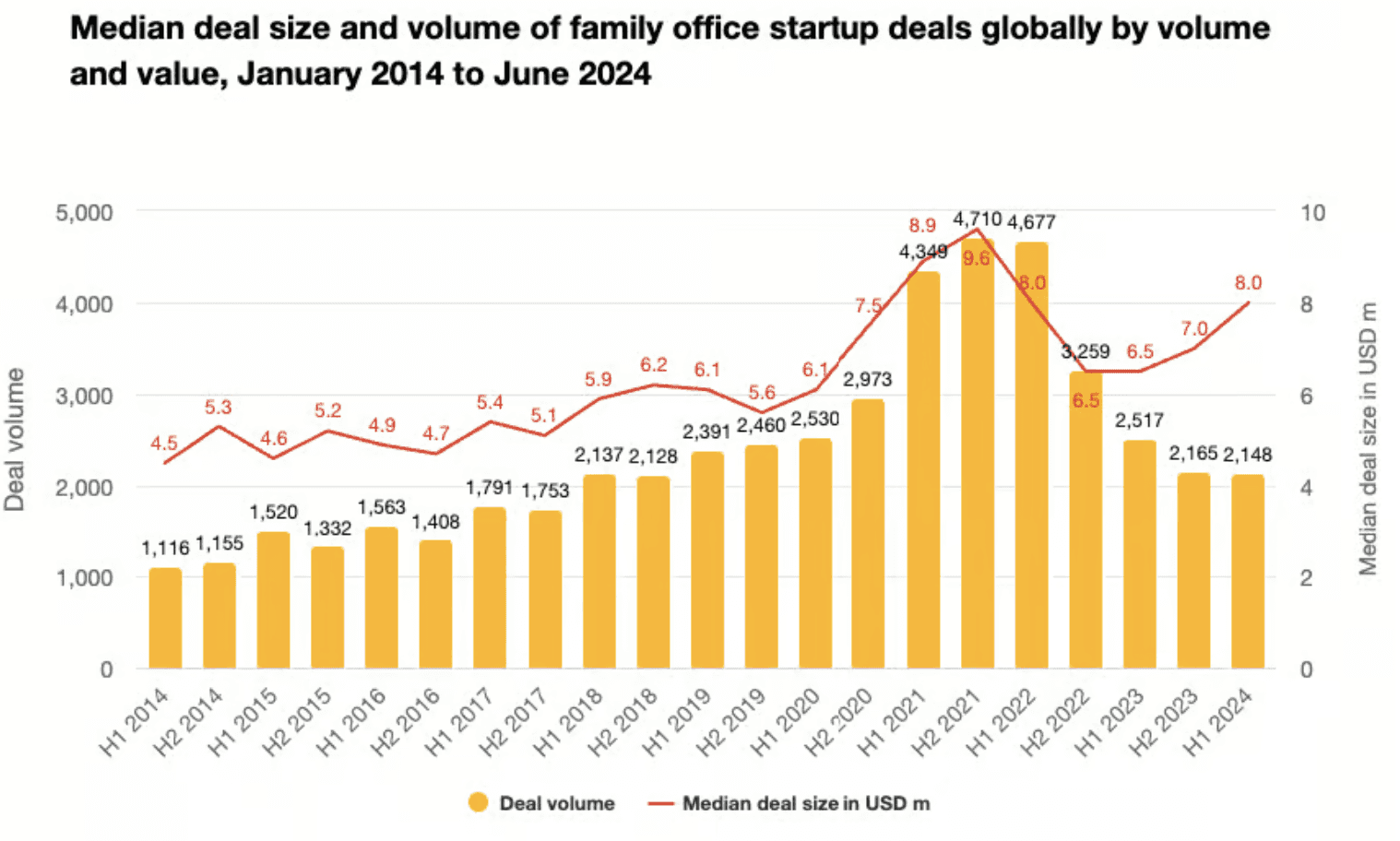

Family offices aren’t just writing checks — they’re becoming strategic investors. PwC reports that while overall investment value dropped sharply from 2021 to 2024, deal volumes have now stabilised, and average cheque sizes are up 23% year-over-year. Rather than chasing every hype cycle, they’re going for fewer but larger and more intentional bets.

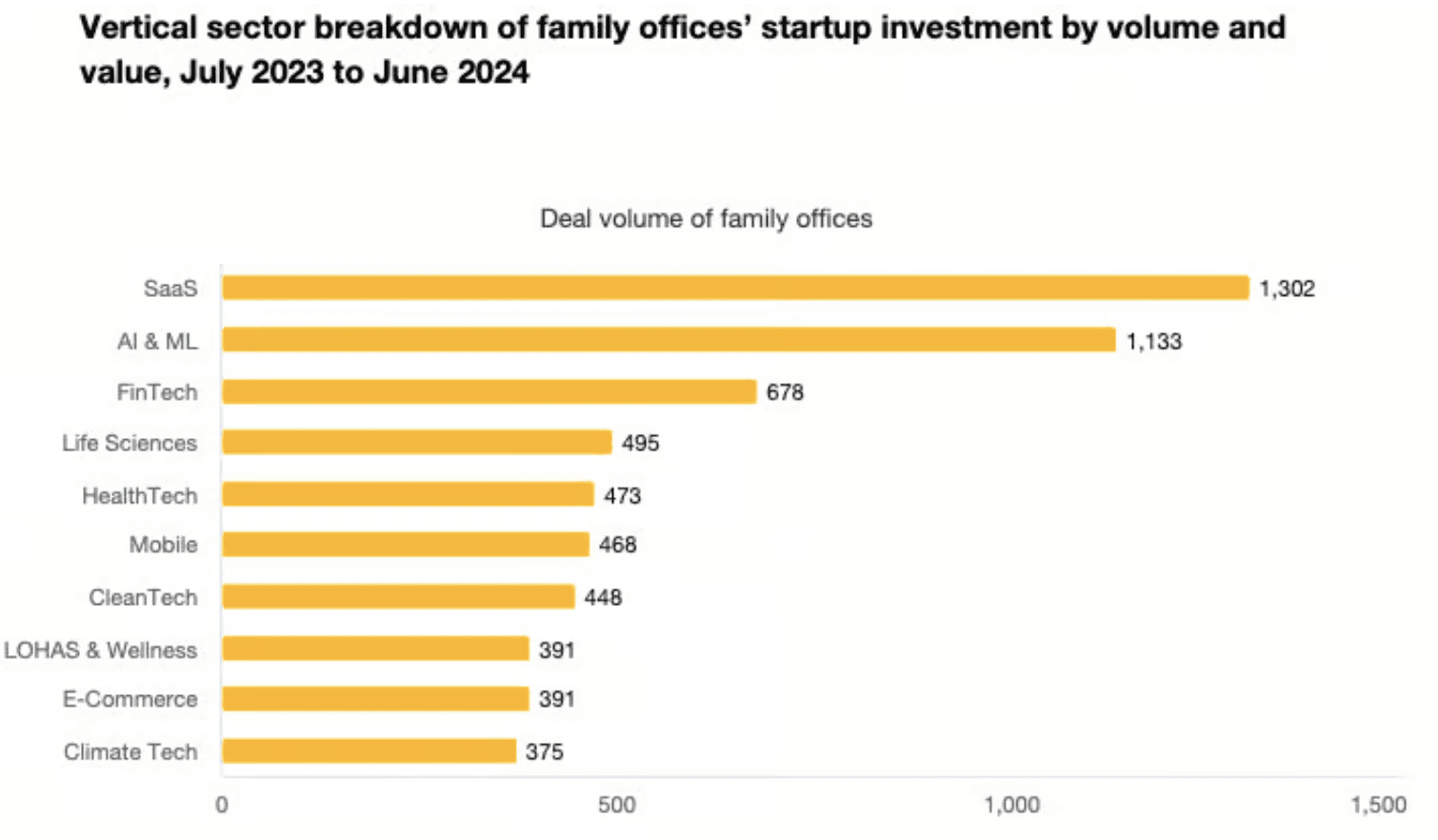

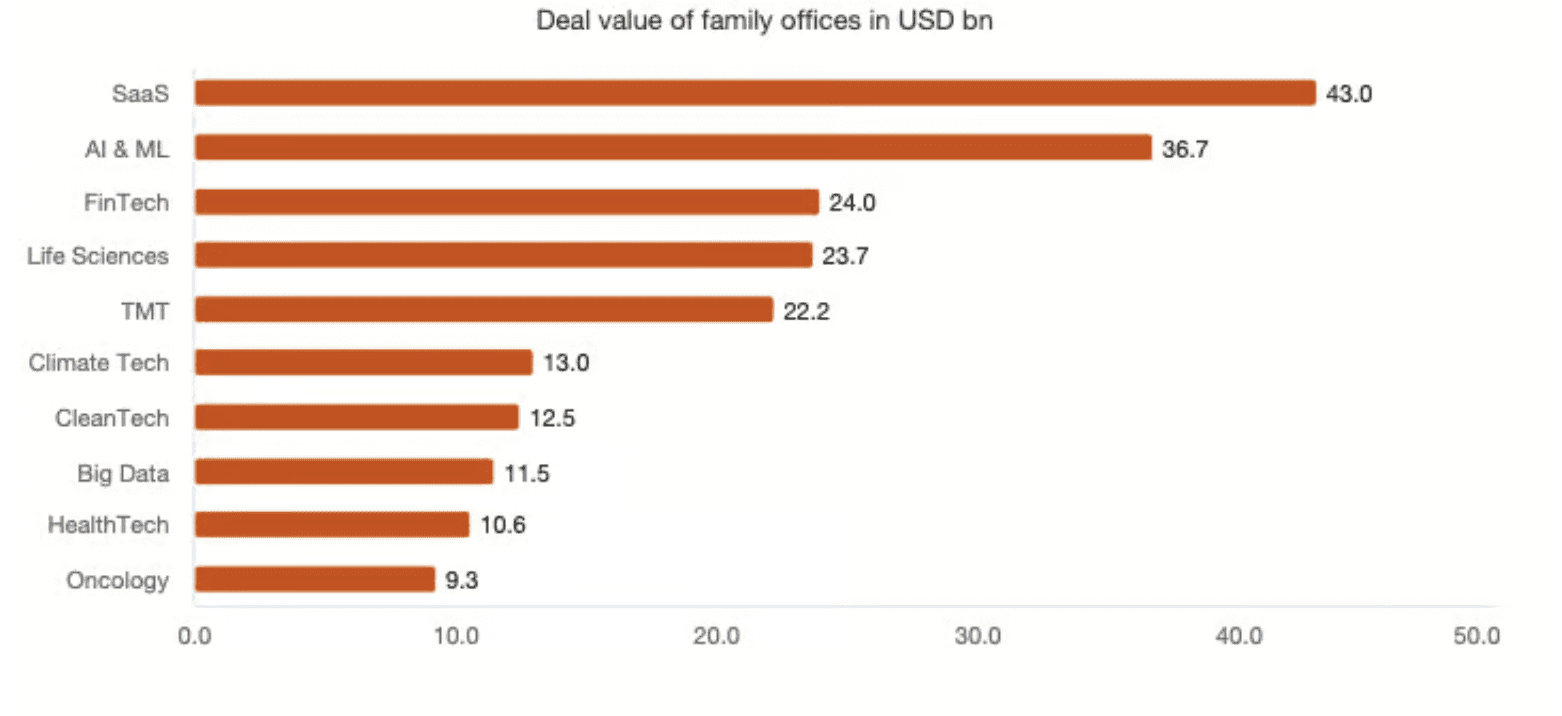

They’re also getting more sector-specific. In the past 12 months, most family office startup investments have been concentrated in AI/ML, SaaS, Fintech, and Life Sciences. Many are doubling down on impact-focused sectors like healthcare, climate, and education — areas where the path to value creation often takes longer, but aligns better with their long-term mindset.

And they rarely go it alone. According to PwC, 83% of family office startup deals are done as club deals — meaning they co-invest alongside others. They’re often not leading rounds, but they play an influential role in shaping them. If one family office is in, it’s common to see others follow quietly behind.

Why Founders Should Care

The shift toward direct investment by family offices creates new opportunities — and new challenges — for founders.

First, more capital is available — but it’s much harder to find. Family offices don’t post on LinkedIn. They don’t host demo days. They work through personal networks and operate in the background. If you want access, warm intros and high-trust referrals are your best route in.

Second, family offices typically bring patient, long-term capital. Unlike VCs who operate on a fund cycle and may push for a fast exit, family offices aren’t under pressure to exit in five years. That can give you more freedom to build sustainably, and to pivot when the market demands it.

Third, they often invest based on values and conviction. Family offices are known for backing companies that reflect their family’s beliefs or long-term goals. If you’re building something purpose-driven, this could be a far better cultural fit than traditional venture.

However, you’ll also need to adjust your expectations. Family offices often:

Write smaller initial cheques

Take longer to make decisions

Avoid high-risk pre-product bets

Don’t always have a structured team to support portfolio founders

A Word of Caution

This space is also becoming riskier — especially in markets like the UK. Because family offices are private by nature, and rarely advertise themselves, the term has become a magnet for people with questionable intentions.

We’re seeing a rise in fake family offices — individuals or small firms claiming to represent wealthy investors, but who are really just seeking information, access, or credibility. Some are harmless consultants. Others are more opportunistic. Either way, founders need to approach unfamiliar names carefully.

Your best defence? Referrals. Real family offices usually know each other — and if someone is truly active, they’re not completely invisible. Ask who they’ve invested with. Ask for founder references. Dig deeper if the website looks vague or if the person can't clearly explain who they represent.

If something feels off, it probably is.

How to Tap Into This Quiet Capital

This isn’t about replacing venture capital. It’s about recognising that the funding landscape is changing — and founders who understand that will have more options.

Here are a few ways to start building access:

Ask your angel investors, lawyers, and ecosystem mentors if they’ve worked with family offices

Start building relationships before you need to raise — family offices often take longer to commit

Be transparent about your timeline and values — many family offices care more about alignment than hype

Finally, keep in mind that while they move slowly, they often follow on quietly. Winning the trust of one family office could open the door to several more.

The Smartest Capital in 2025 Might Be the Quietest

As VC firms shrink funds, reduce new bets, and turn inward to support their existing portfolios, family offices are quietly expanding their presence.

They’re not tweeting hot takes. They’re not doing PR. But they are cutting cheques — on their terms.

So the real question is: Are you in the rooms where this kind of capital flows? Or are you still chasing the loudest money in the room?